Why Research Is Important and Why You Can’t Afford To Think Otherwise

Rafal Hydzik

You’re starting a business. You also have a brilliant idea to back it up, because why else would you even bother? Even though some may believe that a marvelous concept is enough to hit the ground running, it’s often far off. Before the project moves on to (obviously) flawless execution (possibly more important than the idea itself), it needs validation. That’s when smart entrepreneurs invest in market and user research.

Why is research important? For starters, let’s take the mobile app industry. Apparently, you’re more likely to become an NBA player than an owner of a viral app. The market is brutal and absolutely stacked. I can bet you at this moment that every idea you come up has already crossed thousands of minds.

At the same time, don’t fall into the trap of treating the existence of competition as a no-go. There’s this urban legend in marketing about a Coca-Cola vending machine standing on a university campus. People purchased around 50 cans daily. When another vending machine with Pepsi’s logo appeared right beside it, they started selling 100 each.

How’s that possible? The consumers were at first choosing whether they’d like Cola or nothing. When they got a new machine, their choice pool shifted to Coca-Cola or Pepsi.

Competition in fact boosted sales by expanding the range of potential decisions. It can be a boost, if you know how to play the game.

Sure, there are tools for conducting research. When the project’s on a rush, people tend to bring out SEMRush, ahrefs, BuzzSumo, or any other smart platform to speed up the research process. If you’re looking for an approach more cost-effective and oriented towards the quality of collected data, you’ll have to roll up your sleeves and get the job done manually.

Why is Research Important?

When money’s at stake, it’s pointless to be playing a guessing game. Simple as that. Until you have at least brief comprehension of the market and a potential user base, you’re blindfolded.

Also, bear in mind that conducting research isn’t only about validating claims – taking a research approach can (and should!) be the very first step when starting any business.

Gartner states that 42% of app failures come from incorrect research. This means that almost every second failed app is guilty of neglecting the very first step towards success. They most likely repeated their predecessors’ mistakes, targeted a completely irrelevant audience, implemented a solution already present in the market, etc.

Remember that people don’t care about your product or service. They care about how they solve their problem. It’s all about them. You can’t efficiently respond to their pain points without conducting research.

Grasp Niches and Seize Them To Maximise Your Potential

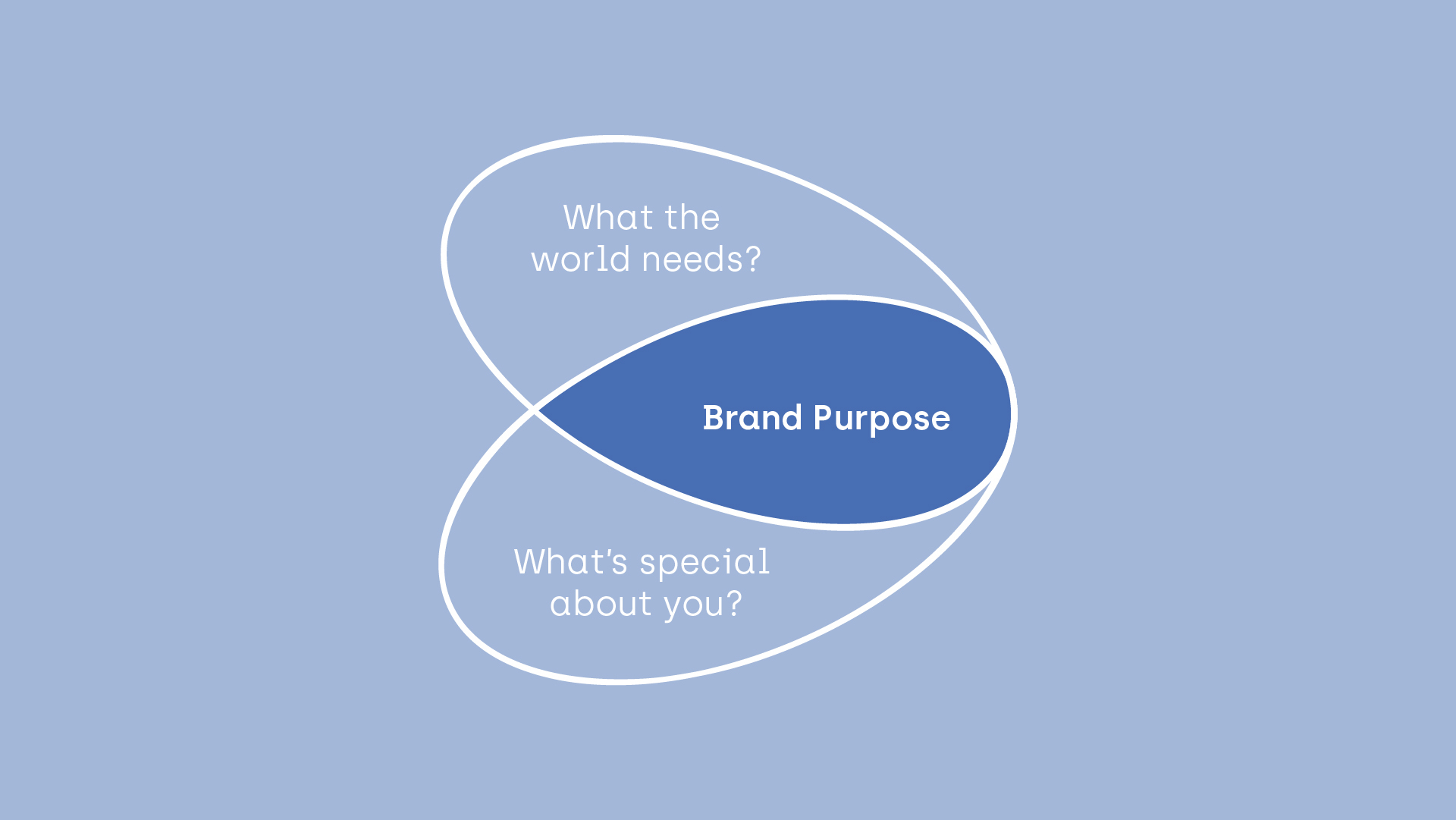

A good way of grasping the importance of research is understanding the concept of purpose used by brand strategists. A very simple framework used to establish the core reason for bringing a new brand to the market is the Brand Butterfly.

The Brand Butterfly created by Brand Vision Architecture is an extremely simple framework that helps entrepreneurs and strategists establish whether their concepts have actual potential

The Brand Butterfly created by Brand Vision Architecture is an extremely simple framework that helps entrepreneurs and strategists establish whether their concepts have actual potential

Essentially, it's about operating at the intersection of the market’s needs and what you can bring to the table. “What the world needs” is the product of your research, while “What’s special about you” is the innovation/concept/idea you start off with. Once you find a common denominator, you’re much closer to taking the right path.

Working on an example – let’s say you’re looking to launch an app and your user research leads you to a previously unknown demographic insight – a large chunk of your consumer base is teenage women. Utilising this information in further design processes could be a very precious differentiator.

Find Pain Points

Possibly the most important part of the research process – thoroughly understanding your users. What do they like? What irritates them? What are they missing in the current market’s offer?

Take a problem-solving research approach. It’s all about taking an empathic approach and designing for emotions. By empathy, I mean making an attempt to understand not only explicit needs, but those more subconscious.

You’re launching an app with a super cool AR feature requiring the usage of a frontal video camera, but what if your users are intimidated when showing their faces? Or maybe you’re offering a complicated technological solution to people who barely grasp the concept of touchpad gestures on their MacBook?

Well, good luck.

Validate Your Own Claims

More often than not, you’ll have a set of presumptions that led you to commitment in the first place. Whether you assumed that your idea is unique or innovative, the market is craving for your solution, or maybe just that your lawyer app will be appealing for Generation Z – you can find out before you invest.

Guidelines of development (inspiration)

As said above – be careful not to fall into the trap of forcing uniqueness. Every market has its big players – they are successful, because they’re doing things right. That’s why you should start filling your strategy with common themes and popular ideas. It’s not unethical to do things the right way.

Think about it as an opportunity to gather (already) good practices and make them even better. After all, that’s what business is about – being better than your competition, not reinventing the wheel.

Competitive Market Research

Every business requires a slightly different approach to the competitive research process. You’re most likely not going to be embracing the same variables when launching a construction company and, as opposed, a mobile app.

We’re no experts in construction, but we feel rather confident in designing digital products. The research process we’ll attempt to show you beneath is what we believe is adequate to our industry.

Conducting Research – How To Start

When preparing a market research process, you need to consider two axis – the first one is study of the current market (competitive benchmarking), while the second is about determining the uniqueness of your solution (comparison and opportunity evaluation).

In both cases, you’ll be better off with at least a brief understanding of your future product. Answer some simple questions, like:

- What category does your product fall into?

- What functionalities will it contain?

- Who do you want to be using it?

Answers provided, a bit of googling will let you identify the market’s strongest competitors. Simply use search phrases like “best fitness apps”, or go more specific – “fitness apps with progress tracking”. Take easily available measures like user opinions, social media exposure, media coverage, etc. to identify the big fishes.

Write them down, as they will be your primary source of inspiration. But remember that good practices aren’t exclusively at the top of the hill. Take a look at what smaller vendors offer. Try to distill anything that’s noteworthy, even from business with minimal exposure.

It’s not rare for decent solutions to fail due to poor marketing plans (or no research strategies!), leaving valuable concepts up for grabs for those who can maximise their potential. It’s like a football club signing a relegated team’s star player.

Build a Framework

Having the required context, you’ll be conducting desk research. With the sole use of smart Google skills, you can find plenty of valuable information. What’s important is to categorise your research process – establish what exactly you’re looking for.

What’s good to consider?

- Quantitative statistics, like social media exposure, app downloads, ratings, etc. This will help you sort every analysed brand into a reliable hierarchy.

- Functionality scope – what do they offer on the technical side? What makes both their UX and features unique and appealing?

- USP (Unique Selling Proposition) – take a look at their communication. Who do they seem to be targeting their solution towards? What do they claim to be unique? What caught your eye?

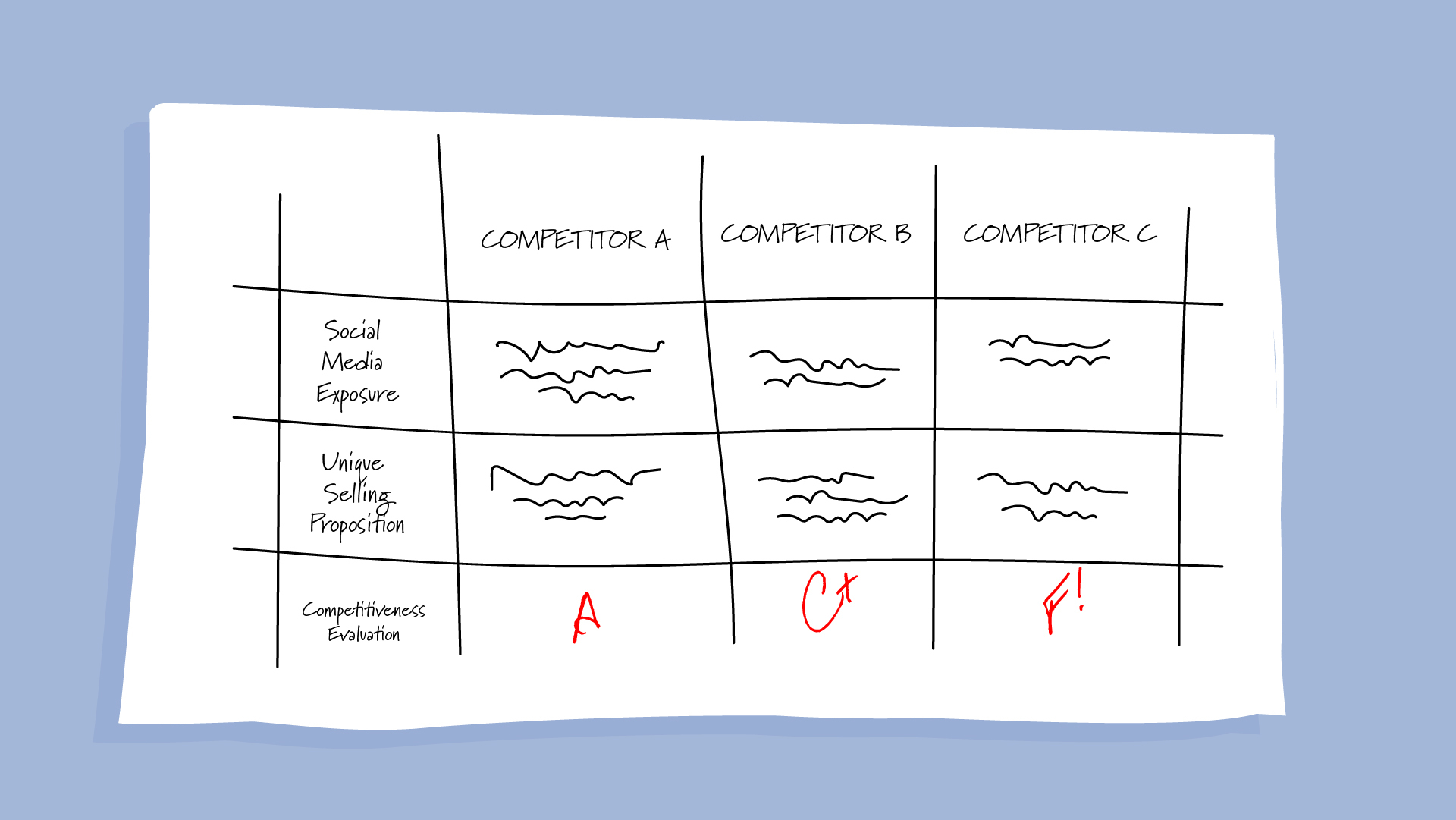

- Competitiveness evaluation – Are they a direct competitor, or do they maybe cover a completely different segment of the market? Consider all collected information to form a subjective estimate of the level of competitiveness.

Analyse each and every competitor using the exact same categories. It will not only make your process simpler and more “automated” but also easier to compare the final results.

Look Inside and Outside

The amount of spaces you can observe your competitors is vast. Starting from their most internal channels like their website, moving on to social media – every word said by a company shapes how it’s perceived. In this emotion-driven business everything, even the dullest possible communication, sends a message. Everything has a personality.

On the other hand, it would be truly naïve to believe that what the company says about itself is the full picture. PR professionals distinguish the terms of “image” and “reputation”. The first one is actively and consciously shaped, while the second fully depends on the public’s opinion.

Dig into reviews, opinions, social media comments, etc. The way consumers perceive your competitors’ brands could be an even more valuable piece of information. Do they praise the usability? Do they notice the design? Or maybe – are they dissatisfied with certain features? Jot it all down.

Inspiration is already piling up.

Summarise

Once you have all the information, throw it into a table. Having all information aligned, you’ll start noticing patterns and strategic opportunities. Comparing each competitor to each other, you can pick those which matter the most competition-wise. A table will help you take a step backwards and look at a bigger picture.

A table lets you see all your research conclusions next to each other. It's easier to study niches and collect inspiration when all information is clearly laid out

A table lets you see all your research conclusions next to each other. It's easier to study niches and collect inspiration when all information is clearly laid out

User Research – Get To Know Your Customers

The best way to get to know your consumers is conducting full-fledged user research, there’s no doubt about that. While most people have at least heard about focus groups or individual in-depth interviews, both methods are time and money consuming.

That doesn’t mean that user research should (or can, for that matter) be neglected. There are alternative, cost effective methods, which can bring similar results without consuming lots of resources.

Qualitative Research – Fork Out Them Pain Points

Robert Kozinets once coined the term “netnography” as a research method based on traditional ethnographic research, but in the online environment. Simple as that – you can take a 3rd person perspective and watch people in their natural (digital) habitat.

Extracting the core of Kozinets’ methodology, you can conduct user research in a simple and insightful way. His netnography utilises publicly available information that people freely share through social media.

It’s all about finding your users on the internet. Lurk around and search for communities concentrated around your niche. A great place to start are Facebook groups and Reddit subs. r/wowthissubexists claims that if something exists, there’s a sub for it.

Once you reach your target group, start absorbing their content. Check what they’re talking about, what they like to share, how do they interact. You don’t have to be proactive in interaction – just observe.

Find their pain points and figure out how to respond to them. Find is the key word here, as they won’t be handed to you on a silver platter.

Actually, the phrase pain points may be even more important. We believe that responding to pain points is the very core of building any solution, digital or not. You have to be solving problems, and a research approach is the tool to establish them.

Facebook Audience Insights

A brilliant tool providing valuable information and statistics all in one place is right at your fingertips. Facebook. Boasting 2,8 billion active monthly users, the world’s largest social media platform is an enormous pool of reliable insights. And they’re all available.

For free.

Facebook Audience Insights is based on an algorithm constantly analysing each user’s behaviour, preferences, and interests. They are then sorted into categories, which can be freely tweaked and changed in order to find satisfying data.

The possibilities can be overwhelming. Facebook Audience Insights will provide you with quantitative, demographic statistics, such as age, gender, relationship status, but also qualitative insights like favourite websites, movies, and pizza places.

Let’s look at an example. Say that your target group are men interested in woodworking. As you’re launching the product in England, you’ll be most interested in users from the United Kingdom and Ireland.

In the 'Demographics' tab you can find key information to build a context for your audience

Straight away you can see that you’ll be targeting a huge group (up to 4 million!). This can be narrowed down by providing more interests (like woodworking machines, joints, etc. – the more variables, the more specific your search). Most men are married, in their late 20s and 30s, and after (or during) college.

But the real magic starts when you lurk into the Page Likes section.

The 'Page Likes' is your qualitative research hub – you can find out which brands are appealing to your audience

An endless list of categories with the most relevant brands will emerge. Your target group is mostly a fan of DEWALT gear, likes to crack open a Guinness, and has a soft spot for classic cars (especially Ford).

Giving attention to each category will help you understand what trends are strong amongst the people you want your brand to appeal to. Find out what they like and blend in by being an answer to their insights.

Facebook Audience Insights is an invaluable tool for simple, yet qualitative user research. Make sure to add it to your pre-launch toolbox.

Conclusion

You can’t afford to neglect research.

That’s it, that’s the conclusion.

Need expert assistance with your digital project?